President of the Barbados Chamber of Commerce and Industry (BCCI) Anthony Branker says while the rush to be ready for VAT-free days can put a strain on the sector, businesses will be better prepared this time around than they were for the first one a year ago.

In an interview with Barbados TODAY ahead of Wednesday’s VAT holiday, Branker also said that while businesses find it difficult to determine the impact of the initiative on their bottom line, he welcomed the opportunity for consumers to shop for goods minus the 17.5 per cent VAT.

Asked whether he wanted to see these VAT holidays occurring more frequently, the business leader said: “The challenge with more VAT-free days is that persons would not shop in their normal patterns and when you disrupt the shopping pattern, it is always challenging then to see if you will actually be making more or if you are really coming out at the same point.

“So, the VAT-free does give an advantage to the consumers which we very much appreciate. It’s more so a gift from Government than it is a gift from the private sector, but it does place a lot of strain on the businesses to accommodate the rush that happens on that day,” Branker added.

The BCCI leader acknowledged, however, that it would be difficult for the Government to give earlier notice for businesses to prepare.

“I do understand that they can’t give us any more notice because we live in a small community and the word will get out. If we had additional notice, people would not be shopping for those days. We have learnt from last year’s VAT-free day and therefore tomorrow should not be as challenging as when we had the first experience,” he said.

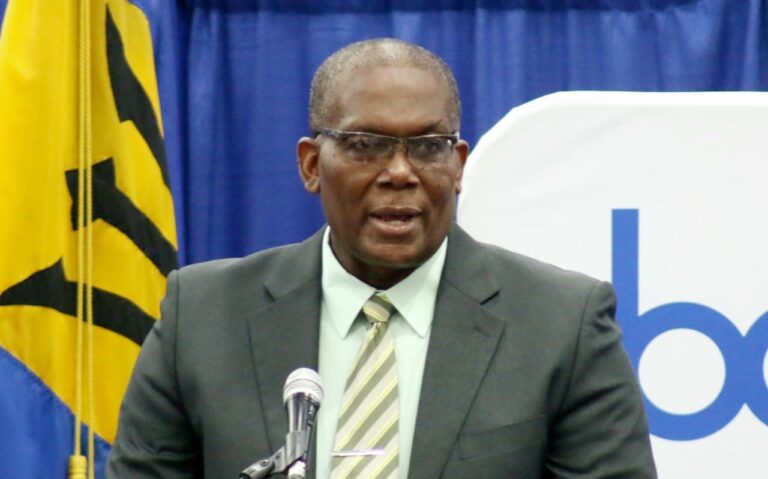

Minister of State responsible for Finance and Economic Affairs Ryan Straughn announced on Monday at a press conference that another VAT holiday would be given on Wednesday – a concession that would cost the Government between $3 million to $3.5 million in revenue.

However, he said, unlike last December when business owners complained they had not been consulted by Government and were therefore not in a position to modify their payment systems to allow for the removal of VAT at the last minute, Straughn said both the BCCI and the Barbados Private Sector Association had been involved in the discussions.

“As was the case last year, the objective is to provide a welcomed ease for consumers which is obviously on top of what has happened already for the year and we feel that the timing is right with respect to being able to do this in a significant way,” he said.

The Minister said only goods are eligible, and those goods had to be available for sale with immediate issuance or delivery to the customer on the day. Hire purchase sales are also eligible but credit purchases, goods on consignment or from wholesale distribution centres are not.

Additionally, Straughn said, the purchase of motor vehicles, gasoline, LPG and diesel, guns, ammunition, cigarettes, and alcoholic beverages are exempt from the VAT ease.

emmanueljoseph@barbadostoday.bb

The post BCCI: Businesses should be better prepared for VAT holiday appeared first on Barbados Today.